AWF v. Goldsmith (Pt. 2): The Andy Warhol Foundation Has a Very Expensive Problem

We we racing for pinks?

Welcome to Day 2! Here is a quick recap of key points from Day 1:

The plaintiff in AWF v. Goldsmith was not Andy Warhol, but The Andy Warhol Foundation.1

Lynn Goldsmith did not sue the Foundation; AWF sought a declaratory judgment against Lynn Goldsmith.

The Supreme Court did not rule on the artwork “Orange Prince,” it ruled on the use of “Orange Prince” on a magazine cover for a $10,000 licensing fee.

Today’s new important fact:

The Andy Warhol Foundation spent over $2.1 million on legal fees between 2017 and 2021. That’s not a misprint. A nonprofit spent over $2.1 million dollars to dispute a $10,000 license.

Does that math add up to you? It didn’t add up to me until I realized that, come Monday morning, AWF has to address an expensive problem.

Spoiler: I have long suspected that AWF v. Goldsmith was partly about creative freedom, but equally about facilitating sales of blue-chip art. That’s quite an assertion; let’s walk through it carefully.

In her dissent, Justice Kagan deliberately conflates the artist Andy Warhol and The Andy Warhol Foundation, the nonprofit corporation that manages the late artist’s massive estate. This elision is allegedly for reader clarity, but it’s actually an act of reader persuasion. I’d like for you to be suspicious of this rhetorical move.

An artist and his estate are not the same being. Andy Warhol was a person. The Foundation is not a person. An artist makes art. An artist’s estate manages intellectual property, sells and authenticates artwork, and shapes perception of the artist’s career. Estates that sell, loan, authenticate, and license artwork operate to increase the value of the artist’s artworks. These estates are money-making ventures.

Thus, if you were troubled by the Citizens United conflation of “person” and “corporation,” then the conflation of “artist” and “corporation that controls his legacy” ought to bug you, too. The Foundation doesn’t make art; it makes money. Yes, it is a nonprofit corporation - a nonprofit corporation that holds more than $388 million in net assets.2

AWF is an immensely large and powerful entity by all standards applied to arts organizations and nonprofit entities. It makes grants to artists, art institutions, and arts writers, and is recognized as an indispensable player in the contemporary art world. However, its power derives from more than its charitable activities. AWF also sells [edit: Has sold? Could someone clarify?] Warhols to billionaires. AWF also merchandises umbrellas, t-shirts, and LEGO.3 AWF earns dramatically more in licensing fees - $3.7 million in 2021 - than it pays out to other artists. It is so massive and powerful that it has perhaps lost awareness of its status as a gatekeeper.

Yesterday, I noted that AWF did not pay Goldsmith part of the $10,000 licensing fee paid by Condé Nast. According to the Foundation’s original complaint, that wasn’t an option. According to the Foundation, Goldsmith threatened litigation, demanded assignment of the Foundation’s copyrights to the entire Prince series, wanted a seven-figure payment, and also wanted an injunction.4 Goldsmith’s original demand is not part of the public record, but Goldsmith flatly denied all of this in her counterclaim and told the court that the Foundation “incorrectly characterize[d] and disclose[d] confidential settlement communications.”5

But still, assuming that there was some kind of Goldsmith-driven conflict, WHY did the Foundation proactively pursue an extraordinarily expensive lawsuit to establish that Warhol’s Prince Series was protected under fair use?

I think asking WHY is deeply important.

As a lawyer, one privately asks “why” to strategize. Why is the counterparty acting like a meathead? What can I do, say, or offer to soothe this savage beast? A lawyer publicly characterizes a “why” to paint the counterparty’s actions and words as bad faith, and persuade the judge that the savage beast is also frivolous and illogical.6

As a historian, one asks why (or better yet, HOW - more on that later) to better understand the bigger picture. I’m not interested in characterizing the Foundation as a bad actor. Morally, I have no opinion of the Foundation. I do find its actions intriguing and unsettling, and I have wondered since 2017, when the complaints were filed, if the Foundation’s board of directors (a) truly saw this litigation as part of its mission of “advancement of the visual arts” OR (b) if the lawsuit was driven by AWF’s other named purpose: “preserving Warhol’s legacy.”

The Foundation paid its lawyers more than $2.1 million in legal fees between 2017 and 2021.7 $2.1 million in legal fees to dispute the legitimacy of a $10,000 licensing fee? That’s just bad math. Was that to advance the visual arts? Or was that a means to establish the status of works already sold? Or an investment in establishing the saleability of works that may be sold in the future?

Legal action is not an obviously charitable purpose for an art foundation.8 I could be wrong, but I have long suspected that AWF v. Goldsmith was partly about creative freedom, but equally about facilitating sales of blue-chip art.

Which is fine, by the way!

Part of preserving a legacy is the preservation and enhancement of market value.

Selling original Warhols is one of the Foundation’s activities. [Edit: Was? I got fascinating private feedback about this.]

As the copyright holder to Warhol works, the Foundation also licenses Warhol images to manufacturers, arts institutions, publishers, and other interested parties.

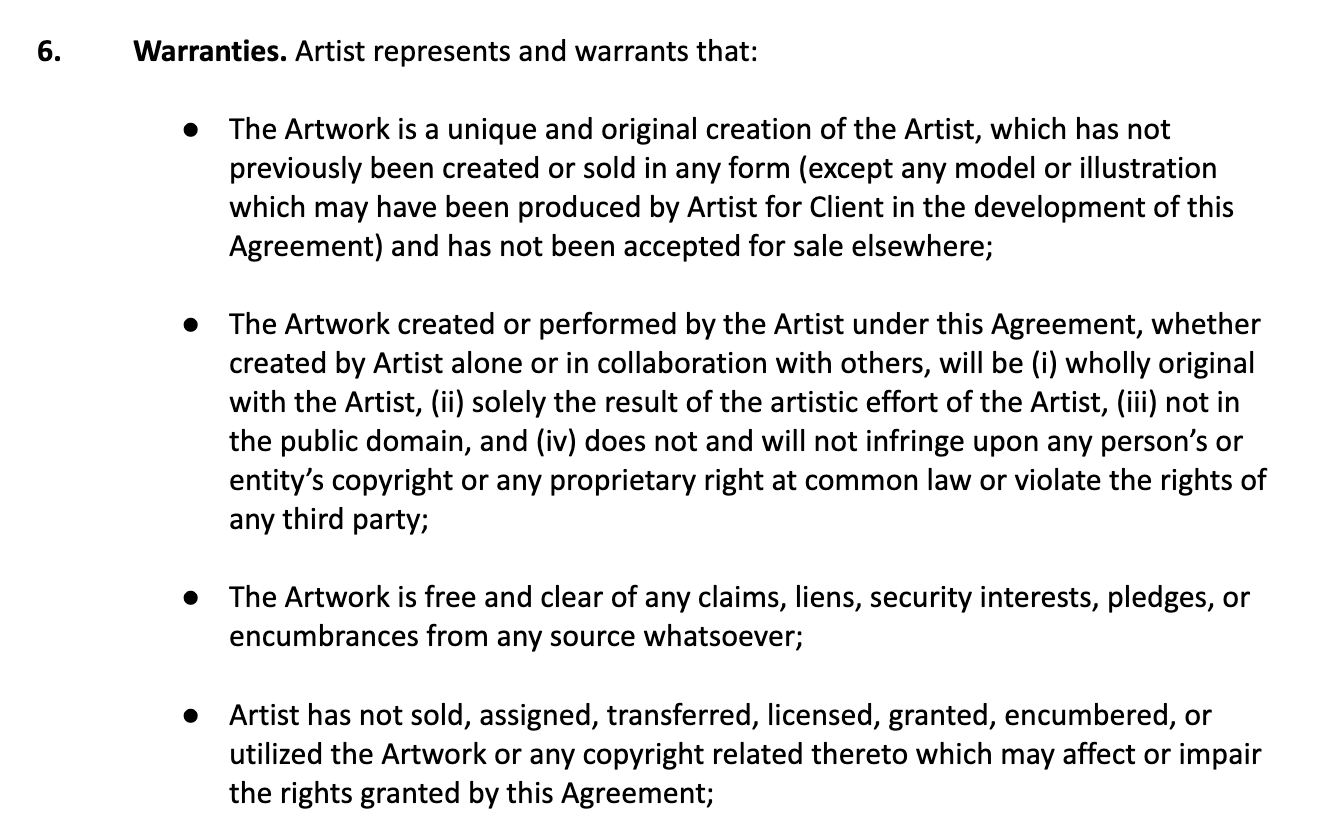

If you’ve ever seen a contract for the sale of art, or a bill of sale, you may recognize the clause below.

That’s a “warranty clause” from one of my firm’s templates. When an artist sells a work of art to a collector, she generally warranties - i.e., makes a legally binding promise - that she has the right to sell all aspects of the artwork. If her work includes pre-existing material, there are only two ways to make that promise valid: (1) get a license from the owner of the pre-existing material OR (2) be damn sure you are covered under fair use.

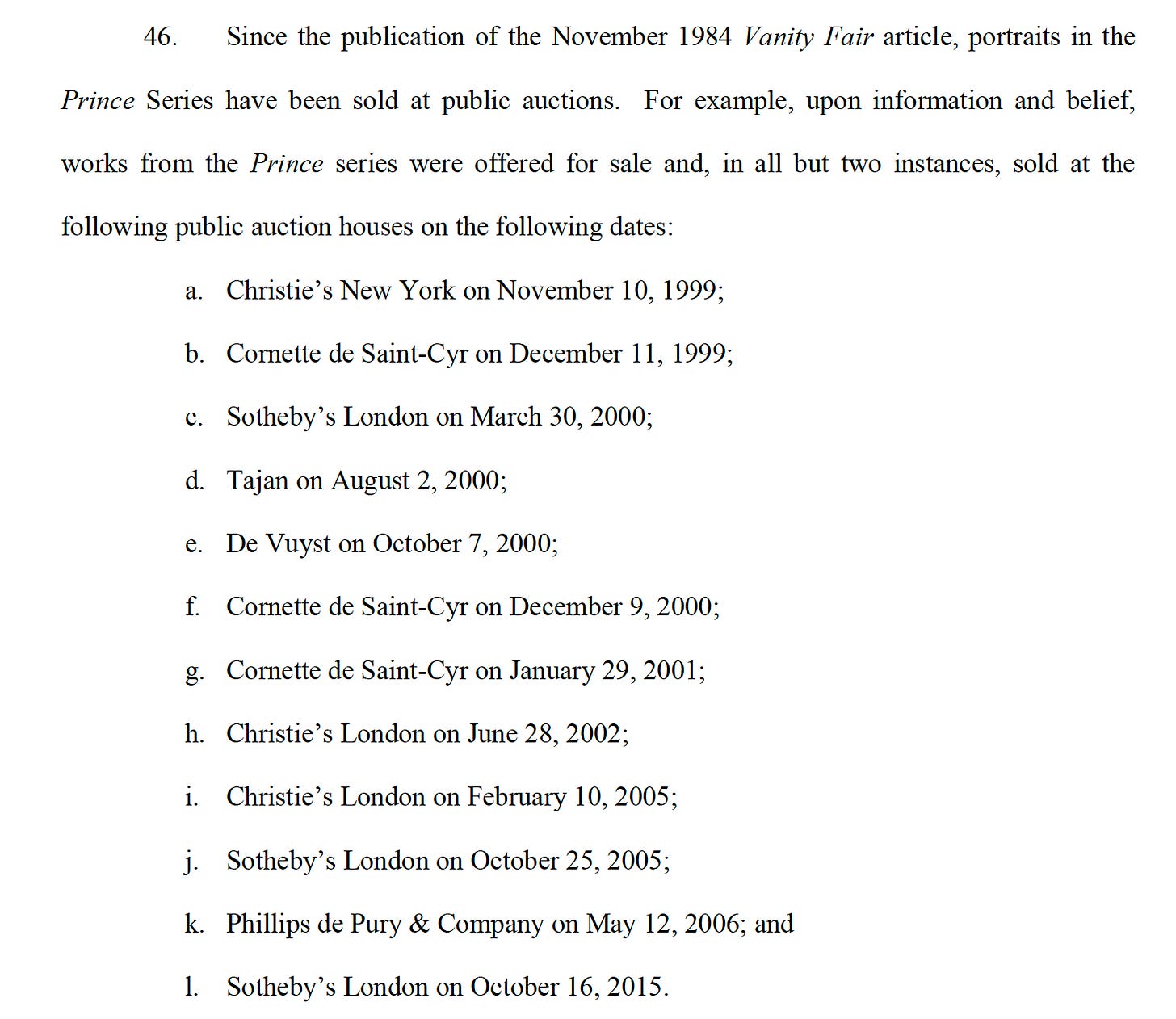

As AWF notes in its original complaint, all 20 works from the Prince Series have been sold.

If the Foundation extended warranties for these works, each warranty could be void, breached, broken, no good.

As of May 18, 2023, the warranty for every sold artwork [edit: not just the Foundation’s holdings, I mean *every* work of appropriation art by any artist] that includes pre-existing and unlicensed material is in question.

We’re talking about billions of dollars of modern and contemporary art.

Guess what? I’m not sad about it.

If you want to sell something for $25 million dollars, if want to buy something for $25 million dollars, you damn well better know if you can convey the display and reproduction rights to the thing.

Lack of clarity around rights ownership is a deeply problematic issue for artists who use pre-existing work. We deal with this all the time in my office. We don’t sue people, because we don’t litigate. Instead, I send polite-but-firm letters asking for a resolution before the show opens, because you might not know this, but we can’t sell the work until you license or assign your copyright. How about this much money? Cool, is a lump sum at the end of the show good with you? Fabulous, send me your address.

It’s honestly not that hard. Except maybe it is that hard when you’re dealing with artworks that sell for $50,000,000 rather than $50,000. Your counterparty is going to ask for a MUCH bigger fee, and will be MUCH more pissed off at you.9

Anyone who understands how markets for art function understands that value is based on consumer perception.10 However, perception may encompass more than the individual art object. In the blue-chip art market, artworks are not priced and sold on the basis of individual merit. (If you don’t know what “blue-chip” means, hit the link and notice the lead illustration.) Artworks are sold based on the identity of the artist. The artist is a BRAND and value is based on the perception of his BRAND. Very much like Adidas. Or Yeezy. Individual artworks are not fungible to the degree that sneakers are, but identical artworks by different artists can have radically different values. But they can tank in value, like Yeezy shoes. One way to tank in value is have challenged pre-existing material in your artwork. The Foundation’s attorney dances around this point in the SCOTUS oral arguments but backs off quickly when it turns into a bad look.

It turns into a bad look because transformation is not established by an artist’s identity. The Foundation made much of Warhol’s use by the Court and lower courts as an example of transformative use.11 Namely, Campbell’s Soup Cans, which is the artist's seminal work. Once Campbell’s Soup Cans had been characterized as the ne plus ultra of transformation, it must have seemed like a slam dunk. Maybe a layup. Not a deep pull-up three.

Yet, fair use doesn’t work like that. Although every Warhol has monetary value because it’s a Warhol, NOT every Warhol is transformative because it’s a Warhol. Monetary value has no impact on transformativeness.12 The Foundation can claim that a given Warhol is worth north of $100 million in the art market because it’s a Warhol; buyers will agree because that’s how prices are set. However, the Foundation cannot claim that the same Warhol deserves protection under the fair use doctrine because Warhol made it; the Court won’t buy it. The doctrine has never worked like that, at least not on the books.13

In practice, the doctrine has worked very much like that for three decades, which is perhaps WHY the Foundation filed for a declaratory judgment. The most successful plaintiffs in fair use cases have been extremely famous artists with (1) the financial resources to hire prominent lawyers and (2) the ability to marshall an army of experts who are highly interested in an outcome that impacts their own net worth and career ambitions.14 Plus, recent circuit court cases such as Cariou v. Prince certainly suggested that the application of new conceptual meaning and messaging to a pre-existing photograph suffices as transformative.

In retrospect, the Foundation’s attempt to clarify fair use for appropriation artists everywhere was a noble goal before “appropriation artist” could be read to include Silicon Valley tech companies (hey, they’re legally “people,” too!). It’s possible that AWF’s deep-pocketed approach to Lynn Goldsmith was also deep-hearted. But I still think the lawsuit was partly motivated by concerns over title and warranties.15

There is so much more to say on this subject. A book-length analysis of the history of the Foundation and its impact on contemporary art and copyright jurisprudence is wholly in order. But, alas.16

Tomorrow, we’ll cover “Who is Lynn Goldsmith?” and talk about the nature of art licensing. That will be the most practical section of the series for our artist readers, and I’m 100% open to answering your general questions (though I can’t give specific legal advice).

I refer to the Andy Warhol Foundation interchangeably as “AWF” and “the Foundation. Call it what you want, just don’t call it “Warhol.”

Did you know that you can access ANY nonprofit organization’s annual filings and learn all this for yourself? Pro Publica and Guidestar are great resources. All of the data in this post comes from the Foundation’s 990s, which you can inspect here.

Why yes, that is the correct way to describe LEGO. Not LEGO kits, not LEGO packs, not “the” LEGO. (Are you proud of me, Rob? Huh?)

Original AWF complaint from 2017. See paragraphs 6 and 54.

Original Goldsmith counterclaim from 2017. See also 6 and 54. Get how complaints and responses work? So organized.

(See paragraphs 6, 54, and the rest of the filings.)

$279,653 in 2021, $604,616 in 2020, $519,657 in 2019, IDK in 2018 because the filings are incomplete, $741,183 in 2017, and $128,324 in 2016.

Before I was a lawyer, I was a tax paralegal.

I used to joke that my academic research is about “fair use and feelings.” Practicing law has taught me to stop joking. Disputes about creative work really are about feelings. Seeing someone more famous than you use your creative work in their creative re-interpretation and sell it for many times the nominal sum you were paid…well, it’s reliably enraging. Cariou’s deposition in Cariou v. Prince, or Sean Fader’s discussion of his appearance in New Portraits are deeply affecting accounts of this phenomenon.

Masters in Art History, 2010, specifically the History of Art Markets. I spent a lot of time at Duke.

Google LLC v. Oracle America, Inc.,141 S. Ct. 1183, 1202-03 (2021) (citing Warhol’s Campbell’s Soup Cans).

This is the kind of point that is proved by its absence in the record. Judges have gone to exhaustive pains to analyze artworks in ways that deliberately avoid discussion of value. Meaning - value is not supposed to impact the way we think of transformativeness, which is technically about the socially valuable addition of new insights and information. Of course, even Supreme Court justices are affected by the assumption that MoMA knows what it’s doing and wealthy art collectors buy the “best.”

The perils of such a calculus have been discussed by law professors Kal Raustiala and Christopher Jon Sprigman, among others. You can find their academic work on the faculty, but they have written great articles for lay readers, too. (Just Google their names.)

Have some inside knowledge? Reach out to me at info[at]devosdevine.com

Ask any of Patrick Cariou or Donald Graham’s lawyers if it was easy to find an art historian or museum professional to serve as an expert for their side. It was not, because taking a stance against Richard Prince could be career suicide for a contemporary art historian dependent on grants from the Andy Warhol Foundation, curatorial relationships with the Guggenheim, and a tenure portfolio to submit to a faculty still entrenched in postmodernist theory.

Guess which grantor funds that kind of book? THE FOUNDATION. Guess whose records you’d need to access to write that kind of book? THE FOUNDATION.

Copyright vests at creation, which is such an interesting, even religious, idea: out of nothing, the universe. Fair use challenges that concept and says, sometimes, appropriation is an element of creation. In our hearts, we know it’s most of the time. The words we read this morning shape the sentences we form this afternoon. Warhol’s genius was to acknowledge it. His estate’s problem was that artistic statement wasn’t necessarily consistent with how the world did business. That’s why they’re the plaintiff. Great stuff.

This is a fantastic series of writings, giving an erudite glimpse into a world most of us never knew existed.